A Stock I Believe Has 3x Upside: Here's Why

Ecora Resources (LON:ECOR): Quality Royalty Business at a 60% Discount to NAV.

I dwell in boredom’s quiet grace,

A UK-listed and commodity trace.

Twice the boredom, twice my thrill.

Summary

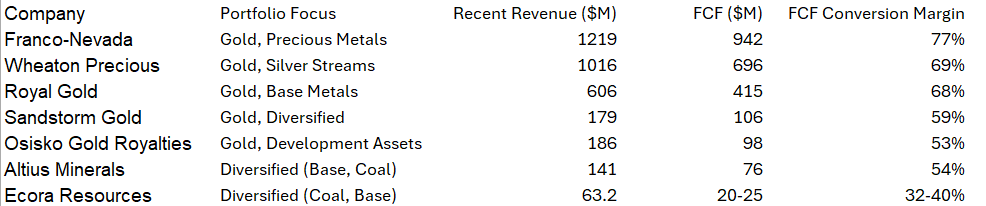

Ecora Resources is a royalty company providing exposure to “future facing” commodities. The royalty model offers exposure to base metals, uranium and vanadium without the operational grind, setting the stage for pleasant surprises when commodity prices or production volumes spike.

The best way I position myself to get surprised is by jumping in when prices are scraped off the floor.

At conservative prices assumptions, the value of PRODUCING assets is about GBP 120 mio vs a mkt cap. of GBP 144 mio. The point is that only half of portfolio is currently producing, the other half is in development and coming online in the next years. Is the value of the other half only GBP 24 mio? I don’t think so.

Let’s discuss a few things first

Capital, in all its forms, tends to migrate to where it is treated best sooner or later.

Aside from finding a lot of dirt cheap mining companies whose stock prices keep dropping, I'm glad to see that the patterns we notice in individual companies are being confirmed on a larger scale as seen in this chart from Crescat Capital:

Historically, such extreme lows have preceded periods of commodity outperformance, especially in inflationary or resource-constrained environments. We're currently navigating a period of elevated inflation, with a real estate guy leading the U.S. And what do real estate tycoons excel at? well …

In addition, with trade tensions rising and alliances weakening, countries are likely to shift trade away from the U.S. and explore alternatives to dollar-denominated assets for their foreign exchange reserves. The era of undisputed U.S. financial dominance may be coming to an end, giving way to a more diversified global reserve strategy. Yep, this is part of the gold thesis, but it likely extends to various commodities.

Another clue to the commodity story comes from government actions worldwide, as they ramp up efforts to secure critical minerals. From Trump’s push to access Ukraine’s mineral resources to Australia’s largest-ever support package for its resource sector:

The CMPTI is a powerful strategic lever that provides the foundation for the Future Made in Australia ambitions of the country,” Association of Mining and Exploration Companies (AMEC) chief executive officer Warren Pearce said.

It’s also the largest ever commitment from the Federal Government to critical minerals.

Ecora Resources

To understand why the stock’s tanked 70% since 2022, let’s quickly rewind and look at the backstory:

1967-2014: Coal-Focused Era as Anglo Pacific Group - Launched in 1967 as Anglo Pacific Group, the company built its business around coal royalties. A big chunk came from thermal and metallurgical coal, with the Kestrel mine in Queensland, Australia, as a crown jewel—supplying high-quality coking coal since the 1990s. By 2014, with coal losing favor amid climate concerns, the company began eyeing a shift toward metals like copper and nickel.

March 2021: Voisey’s Bay Cobalt Stream - Under Julian Treger, Ecora dropped $205 million on a cobalt stream from Vale’s Voisey’s Bay mine in Canada.

April 2022: Marc Bishop Lafleche Becomes CEO, Strategy Sharpens - Treger stepped down, and Marc Bishop Lafleche took over as CEO in April 2022, doubling down on the shift Treger started. Lafleche, who’d joined as Chief Investment Officer in 2020, brought a fresh push to align the portfolio with sustainable commodities, setting the stage for the rebrand.

October 2022: Rebrand to Ecora - With Lafleche leading, the company rebranded from Anglo Pacific to Ecora Resources, cementing its green metals focus. That same month, it snagged a $185 million copper and nickel royalty portfolio from South32, a massive step to diversify away from coal and into energy transition metals.

Portfolio Exposure

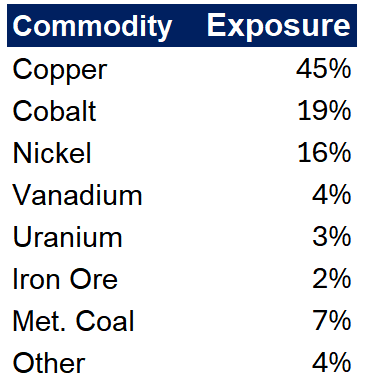

As a result of the above, this is the exposure of the portfolio:

The cobalt market has been struggling, with prices hitting a multi-year low of $10 per pound before the Democratic Republic of Congo (DRC) unexpectedly imposed an export ban in February 2025. Despite weak prices, global production kept rising—from 238,000 metric tons in 2023 to 290,000 tons in 2024. That’s because cobalt is mostly a byproduct of nickel and copper mining, meaning output isn’t easily cut back like it is for other commodities. The DRC’s four-month export freeze has triggered a short-term rally, pushing the most-active CME contract up to $15 per pound in just a week. But this ban could just be kicking the can down the road. If demand doesn’t pick up, we might just see stockpiles grow—something that has happened before with other oversupplied commodities in the DRC. To make matters worse, the EV industry—one of cobalt’s biggest consumers—seems to be pulling back. Automakers are increasingly shifting toward battery chemistries that use little or no cobalt, which could further weigh on demand in the long run.

So what’s the deal here?

The shift away from cobalt in EV batteries—driven by the rise of lithium-iron-phosphate (LFP) alternatives—has a lot to do with cobalt’s price swings. Prices soared in 2022 before crashing, pushing automakers to seek cheaper, more stable options. But now, guess where we stand with prices:

I could throw countless forecasts at you predicting rising cobalt demand, but I don’t put much faith in any of them. My reasoning is much more straightforward. With cobalt prices at rock-bottom levels, it naturally becomes more attractive for manufacturers to use. But there’s more to it than that.

History has repeatedly shown that when a commodity becomes cheap enough, it often finds new applications or re-emerges as a viable substitute for other materials. Take aluminum, for example—once considered an expensive luxury metal in the 19th century, its price eventually collapsed with advances in extraction, leading to widespread adoption in everything from aerospace to beverage cans. More recently, when nickel prices spiked, stainless steel producers found ways to use lower-grade ferritic stainless steel, which contains little to no nickel, to cut costs. When prices later fell, nickel-heavy stainless steel grades regained popularity.

Beyond EVs, cobalt still plays a crucial role in defense, especially in super-alloys used for aviation and aerospace. The U.S. Geological Survey even classifies it as a critical mineral, highlighting its strategic importance. That could be reason enough for the West to strike a deal with the DRC to secure supply—especially given cobalt’s dual-use in both civilian and military tech.

The 2021 Voisey’s Bay Cobalt Stream deal turned out to be a bad one—locking in royalties when commodity prices were high is rarely a smart move. But today, with cobalt prices at rock-bottom levels, there’s a chance to gain exposure at a fraction of the cost.

Going to copper, the outlook might seem overly bullish, but the long-term case remains strong. According to BHP’s report How Copper Will Shape Our Future (September 30, 2024), global copper demand is expected to jump by 22.1 million metric tons between 2021 and 2050—a 70% increase. To put that into perspective, meeting this demand would require over 16 new Escondida-sized mines (the world’s largest, producing up to 1.35 million metric tons annually) while still maintaining current production levels. The deal here is that massive new projects are becoming harder to develop, making supply growth a serious challenge.

Nickel demand could rise sharply with the growth of EVs and stainless steel, but like cobalt, oversupply is keeping prices low for now. Uranium is getting a boost from the global push for cleaner energy, with the World Nuclear Association expecting demand to jump 27% by 2030—enough to support dozens of new reactors. Vanadium, used in steel alloys and next-gen batteries, could also benefit from infrastructure expansion and renewable energy storage, potentially requiring new projects on the scale of South Africa’s Bushveld complex.That said, like copper, major new discoveries are becoming rarer, which could limit supply growth.

Overall, when a commodity is at rock-bottom levels, there’s plenty of upside—and plenty of ways to win by picking things up off the floor.

Assets

The operators of Ecora’s assets include industry giants like Vale, Rio Tinto, BHP, and Cameco. With most assets positioned in the lower-cost half of the global cost curve, I would argue the portfolio looks fine.

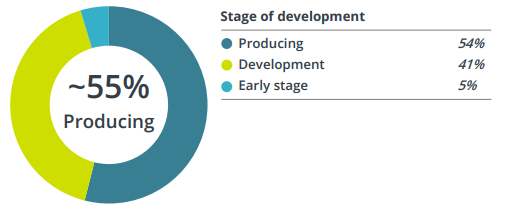

54% of Ecora’s assets are producing (listed below), 41% are in development, and 5% are in early stages—meaning just over half of its investments generate revenue today. The market may not like this, as milestones years away don’t sit well with portfolio managers.

Near-term revenue stability is another concern (for portfolio managers!), especially with Kestrel—Ecora’s biggest cash generator—winding down. Production in its royalty zone is set to drop sharply after 2026, cutting contributions from $33.6–$35.2 million in 2025 to $2–$4 million by 2027.

The West Musgrave copper-nickel project, despite robust economics as noted by BHP, faces delays with its construction suspended since October 2024 due to a global nickel oversupply and weak prices, with BHP set to review this suspension by February 2027, further deferring revenue contributions and possibly dampening market sentiment.

At the company level, there are short-term catalysts that could drive momentum in 2025:

Voisey’s Bay is ramping up cobalt production, increasing Ecora’s share from 210 tons in 2024 to 340–390 tons in 2025, with further growth to 560 tons annually until 2035.

Mantos Blancos will maintain higher mill production, while Capstone Copper’s Phase 2 feasibility study (expected by year-end) could unlock more capacity. A potential Phase 3 high-grade tailings retreatment could add 25,000 tons of copper annually for 15 years—a 50% production boost with minimal costs.

Ramping up the Mimbula copper project in Zambia, just recently acquired, going from 14 kt to 15-20 kt.

My Value Ramblings

I usually avoid using Excel for valuing investments, but I wanted to see what numbers I'd get with very conservative assumptions (detailed in the appendix).

Of course this leads to a portfolio contribution that's significantly lower than analysts’ estimates. Even so, I still arrive at a net value of £123 million for the producing assets (after debt), compared to a market cap of £144 million. The point is that I’m doing a forecast on conservative assumptions of half of the portfolio! I’m nowhere near considering all of these assets below:

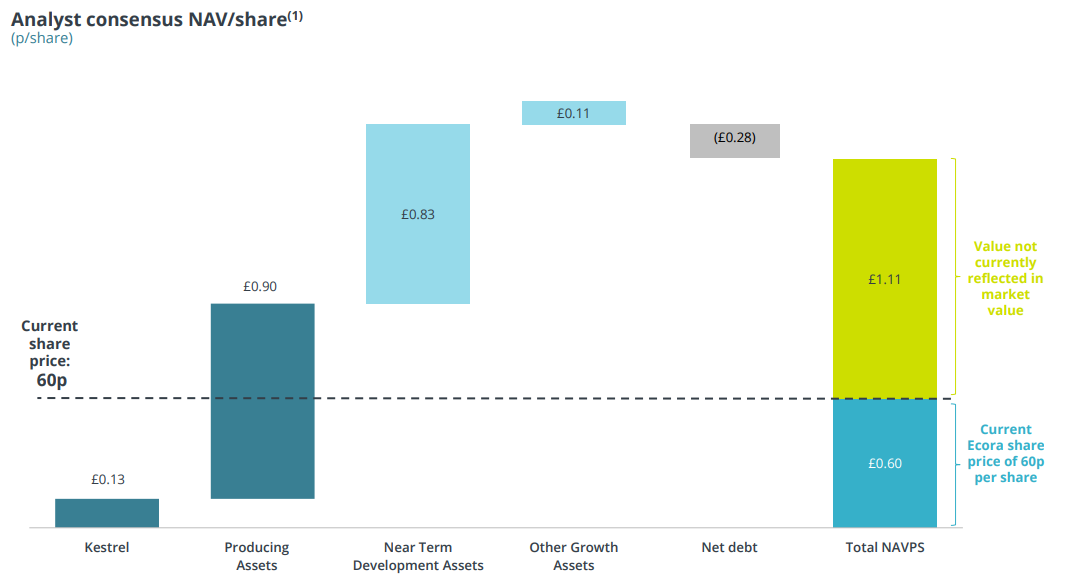

This makes me think that these NAV estimates may not be fairytales after all:

If I take everything into account—including assets in development—and simply trust management’s assumptions (over $100 million in mid-term revenue, excluding Kestrel), then applying a 50% FCF conversion and a reasonable 10x multiple, we could be looking at a £500 million market cap—3.5x the current level.

Boring commodities,

Boring UK,

Value (suuuuper boring),

Disclaimer: I own shares at the time of writing.

Sincerely,

The Boredom Baron.

Disclaimer:

The content of this article reflects my personal views and is provided for informational and educational purposes only. It does not constitute investment advice, financial advice, or a recommendation to buy or sell any securities or financial instruments.

While I strive for accuracy, the information presented may contain errors or omissions, or be based on sources believed to be reliable but not independently verified. I make no representations or warranties as to the completeness, accuracy, or timeliness of any information presented.

This article is not intended to provide, and should not be relied upon for, investment, legal, tax, or accounting advice. The securities and strategies discussed may not be suitable for all investors. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal.

I may hold, or have held, positions in the securities mentioned. I do not receive compensation for writing this article, nor do I intend to influence the price or trading volume of any security discussed. All opinions are subject to change without notice.

This content is written strictly in a personal capacity and does not reflect the views of any employer, organization, or associated entity. Readers are strongly encouraged to conduct their own independent research and to consult with a licensed financial advisor before making any investment decisions.

Appendix

Volumes and Prices

Comparables

Copper Forecast (we’re just at the beginning!)

Voisey’s Bay

Company’s outlook

Most recent acquisition

This is a great write up, much more conversational in tone than most of investing substack and thus more readable.

I had never heard of this company but the case you make for it is very compelling. It’s definately at least going on the watchlist

great discursive style of write up, i'll have to reach to yahoo or other to get the financials. Most impressively, i love the comments below, a very real & candid discussion with the author fully involved & appreciative enough to understand pros & cons. Bravo!